After Dissolution the Partnership Does Not Continue for Even a Day Quizlet

Accounting Procedure of Dissolution of Partnership Firm!

The dissolution of partnership among all the partners of a firm is called the Dissolution of the Firm (Sec. 39 of the Partnership Act, 1932). Dissolution of Partnership involves a change in the relation of partnership business, if the remaining partners resolve to continue the concern. In such cases there will be a new partnership but the firm will continue in a reconstituted form.

Dissolution :

Dissolution of firm means complete breakdown of the relation of partnership among all the partners. When all the partners resolve to dissolve the partnership, the dissolution of firm occurs, i.e. the firm is wound up.

If the business comes to an end, it is said that the firm has been dissolved. Dissolution of firm means the closing down of the business. Firm's dissolution implies partnership dissolution but not vice versa.

That is dissolution of partnership does not mean dissolution of firm, but the dissolution of firm will be dissolved on any one of the following ways:

(A) Dissolution by Agreement (Sec. 40):

A firm may be dissolved at any time with the consent of all partners. For instance, when a firm does not expect good prospects in the future, a firm can be dissolved by mutual consent of all partners.

(B) Compulsory Dissolution (Sec. 41) :

A firm is compulsorily dissolved by operation of law when all the partners except one become insolvent or when all the partners become insolvent or when business becomes illegal or when the number of partners exceeds twenty in case of ordinary business or ten in case of banking.

(C) Dissolution on the Happening of Certain Contingencies (Sec. 42) :

A firm is dissolved, in the absence of contrary, in the event of any of the following circumstances:

(i) The expiry of the term for which it was formed.

(ii) The completion of the venture for which the partnership was constituted.

(iii) The death of a partner.

(iv) The adjudication of a partner as an insolvent.

(D) Dissolution by Notice of Partnership at Will (Sec. 43):

Where a partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm.

(E) Dissolution by the Court (Sec. 44):

The court is empowered to order the dissolution of a firm consequent on a suit by a partner in the following cases:

(i) When a partner becomes insane or unsound of mind.

(ii) When a partner becomes permanently incapable of performing his duties, be it mental or physical.

(iii) When a partner is proved guilty of misconduct which is likely to affect adversely the business of the firm.

(iv) When a partner conduct himself in such a way that it is not possible for the other partners to carry on partnership with him.

(v) When a partner transfers his interest or share to third party.

(vi) When the business cannot be carried out except at a loss. (It must be remembered that the object of partnership is to earn profits and if that object is not fulfilled, the firm can be dissolved).

(vii) When it appears to be just and equitable. For instance, continued quarrelling, deadlock in the management, refusal to attend matters of business, absence of cooperation etc. among the partners. (The court has wide discretionary powers).

Liability for Acts Done After Dissolution (Sec. 45):

When a firm is dissolved a public notice must be given of the dissolution. If it is not done, the partners continue to be liable as such to third parties for any act done by any of them after the dissolution, and in such a case, the act of a partner done after dissolution is deemed to be an act done before the dissolution.

Settlement of Accounts (Sec. 48) :

As soon as a firm is dissolved, it ceases to transact normal business. The mode of settlement of accounts between partners after the dissolution of a firm is determined by the partnership agreement. In the absence of any specific agreement as to the mode of settlement of accounts after the dissolution of the firm, the Partnership Act laid down the following provisions (Sec. 48) for settlement of accounts.

(a) Losses, including deficiencies of capital, shall be paid first out of profit, next out of capital, and lastly, if necessary, by the partners individually in their profit-sharing ratio.

(b) The assets of the firm including any sums contributed by the partners to make up deficiencies of capital shall be applied in the following manner and order:

(i) In paying the debts of the firm to third parties.

(ii) In paying each partner rateably what is due to him from the firm for advances.

(iii) In paying to each partner rateably what is due to him on account of capital, and

(iv)The surplus, if any, will be divided among the partners in their profit sharing ratio.

Firm's Debt and Personal Debts :

Where debts are owing both the firm and the partners individually, the rule under section 49 is:

(i) To apply the firm's assets first in paying off the firm's debts and out of the surplus left, if any, each partner's share thereof is applied in meeting his personal debts, and

(ii) To apply the private property of each partner first in paying off his personal debts and the residue, if any, is applied to pay off the firm's debts.

Dissolution Accounts :

When a business is discontinued, the firm is said to be dissolved. As a result, all the accounts be closed. It is, therefore, necessary to open Realisation Account, Cash or Bank Account and Partners Capital Accounts.

(i) Realisation Accounts is opened for all transactions relating to realisation of assets and payment of liabilities. That is, on dissolution, it is essential to make sale of assets of the firm, realize cash and paying off the liabilities.

Realisation of assets and settlement of liabilities are centred round the Realisation Account. It is a nominal Account. The transactions – realisation and settlement – are over, the difference, being gain or loss will be transferred to Capital Accounts.

(ii) Cash/Bank Account is opened to record all cash transactions. When the purpose is over the Cash Account shows a balance, which is equal to the amounts due to partners.

(iii) Capital Accounts are opened to make all entries connected with the partners' accounts. Current Accounts, if any, are transferred to Capital Accounts. Finally the Capital Accounts are closed by receiving or paying cash.

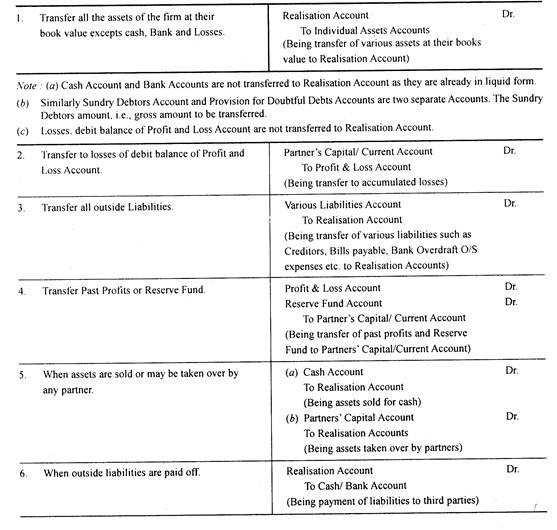

The following steps are taken to close the books of accounts:

To sum up, when all the assets are realized and the liabilities are paid off, the balance of cash or Bank must be equal to the amount due finally to the partners' capital account, after transferring the current account, if any. Sometimes, the capital account shows a debit balance, representing the amount due to the firm by the concerned partner.

The principle of unlimited liability is applied, that is, the partner, whose capital account shows a debit balance, should bring the amount to clear off the debit balance in his capital account. Then the cash in hand plus the amount so received, is applied in paying off all the partners whose accounts show credit balances. Thus, all the accounts of assets, liabilities, partners' capital, and cash are closed.

The above method of preparation of Realisation Account is called Total Method. Alternatively, there is another method, known as Balance Method to prepare the Realisation Account.

Under the Balance Method, the assets appearing in the Balance sheet are not transferred to Realisation Account at their book value. But, only the difference between the Book Value of Assets and the amount realized by their sale is transferred to Realisation.

The sales proceeds are not taken through Realisation Account. The liabilities too are not transferred to Realisation Account but only the difference between the book value and payments paid is transferred to Realisation Accounts.

For instance, consider the following:

Note: Return of Premium on Premature Dissolution:

Where a partner has paid a premium on entering into partnership for a fixed term, and the firm is dissolved before the expiration on the term otherwise than by the death of a partner, he shall be entitled to repayment of the premium or of such part thereof as may be reasonable unless the dissolution is mainly due to his own misconduct, or the dissolution is in pursuance of an agreement containing no provision for the return of the premium or any part of it.

Illustration 1 :

The following is the Balance Sheet of a firm as on 31st December 2005:

The firm was dissolved on 31st December 2005.

The assets were realized as follows:

Debtors Rs. 1,500; Machinery Rs. 3,000; Stock Rs. 1,200 and Factory Premises Rs, 10,000.

Bank overdraft and Bills Payable were paid in full. Creditors were settled in Rs 7,800. Realisation expenses amounted to Rs. 200.

Pass journal entries and prepare ledger accounts to close the books of the firm assuming that the profit sharing ratio between Ram and Shyam is 3: 2.

Illustration 2:

A, B and C sharing profits in the ratio of 3: 2: 1, agreed upon dissolution of firm. A was appointed to realize the assets and pay off the liabilities for which he was entitled to a lump-sum amount of Rs. 1,000.

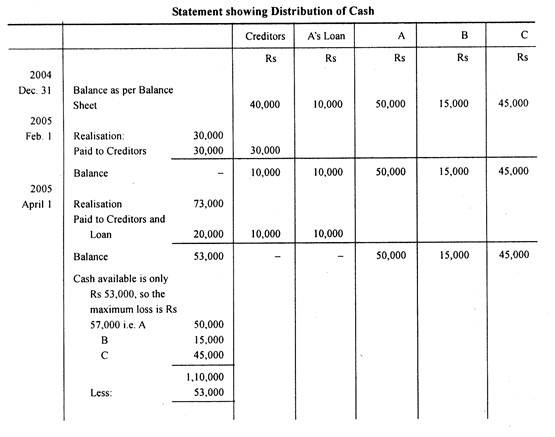

The Balance Sheet of the firm on 31st December 2005 was as under:

The investments are taken over by A for Rs 18,000. B takes over all the stocks at Rs, 7,000 and debtors amounted to Rs 5,000 at Rs 4,500. Machinery is sold for Rs 55,000. The remaining debtors realize 50% of the book value. Prepare necessary ledger account on completion of the dissolution of the firm.

Illustration 3 :

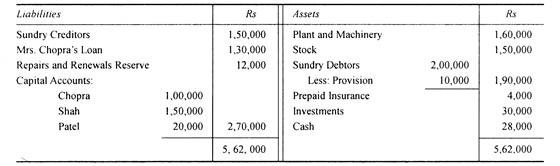

Chopra, Shah and Patel were carrying on business as manufacturers of sports goods. The profit-sharing ratio was 3:2:1 respectively.

Their Balance Sheet on 30th June 2005 was as under:

On this date the firm was dissolved.

The assets realized as under:

Plant and Machinery – Rs. 1, 00,000

Stock – Rs. 1, 20,000

Sundry Debtors – Rs. 1, 60.000

The investments were taken over by Chopra at a value of Rs. 20,000. He also agreed to pay Mrs. Chopra's loan. During the course of realisation it was found that a bill for Rs 50,000 previously discounted by the firm was dishonored and had to be paid.

Expenses of realisation come to Rs 8,000.

Prepare Realisation Account, Partners' Capital Account and Cash Account.

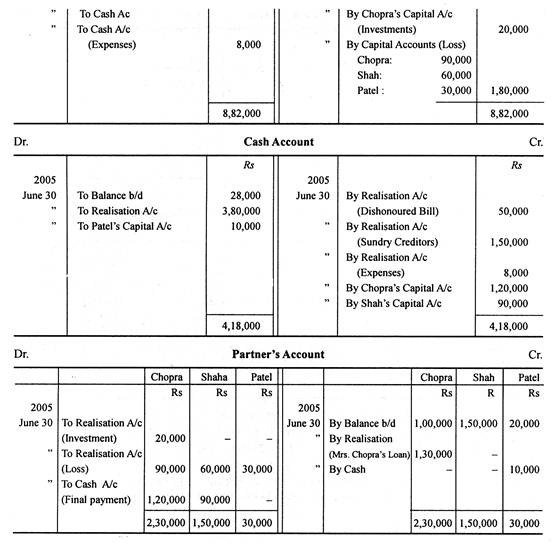

Solution:

Illustration 4 :

X, Y and Z sharing profits and losses in the proportion of 3: 2: 1 decided to dissolve partnership on 31st December 2005 on which date their Balance Sheet was as under:

The Joint Life Policy is surrendered for Rs 10,000. The investments are taken over by Y for Rs. 8,000 and X agreed to discharge the Bank Loan. The remaining assets are sold for Rs 86,706. The expenses on realisation amount to Rs. 850.

Show the necessary ledger accounts including the final settlement of the partner's accounts.

Illustration 5 :

The following is the Balance Sheet of Sudhir and Ramesh as on 31st December 2005:

The firm was dissolved on 31st December 2005 following was the result:

(i) Sudhir took over investment at an agreed value of Rs, 16,000 and agreed to pay off the Loan to Sudhir's wife,

(ii) The assets realised as under:

(iii) The Sundry Creditors were paid off less 2.5% discount.

Sudhir and Ramesh share profits and losses in the ratio of 3:2.

Show Realisation Account, Partners' Capital Account and Cash Account.

Prepare Realisation Account, Partners' Capital Account and Cash Account.

Illustration 6 :

A, B and C were sharing profits in the ratio of 3: 2: 1.

They agreed to dissolve the partnership since the business was running under continuous loss.

On that date their Balance Sheet stood as under:

The life policy was surrendered for Rs. 12,000. The investment was taken over by A for Rs. 17,500. A agreed to discharge his wife's loan. B took over all the stock for Rs. 7,000. Debtors worth Rs. 5,000 were also taken over by A at Rs. 4,000.

Machinery was sold for Rs. 55,000. The remaining debtors realized 50% of the book value. The expenses of realisation amounted to Rs 600.

It was found that investment worth Rs 3,000 was not recorded in the books. The same was taken over by one of the creditors at this value. Prepare the necessary ledger accounts and close the books of the firm.

Illustration 7 :

Ramesh and Suresh are equal partners.

They decide to dissolve the partnership on 31st December 2005 when their Balance Sheet was as follow:

Ramesh is to take over the business and pay Rs. 6,000 for goodwill, which had not been previously valued. He is also to take over the premises and stock at book values and plant at Rs. 9,000.

During the period up to 30th April 2006, they collect Rs. 2,400 from the firm's debtors and pay and liabilities getting Rs. 120 for cash discount. He also pays for the cost of dissolution agreement amounting to Rs. 240.

You are required to prepare the Realisation Account, Cash Account and Partners' Capital Accounts, showing the amount Ramesh pays to Suresh assuming the settlement was made on 30th April, 2006.

Illustration 8:

A, B and C carrying on business sharing profits and losses equally agreed to dissolve the partnership on 31st December 2005.

X agreed to take the entire stock in full settlement of his loan. Sundry Debtors were realized at Rs. 20,000 and Creditors were settled at Rs. 34,000.

It was decided that A and B would take over the following assets at the following sums:

A and B decided to form a partnership sharing profits and losses in the ratio of 3: 1. It was agreed that the firm would require a total capital of Rs. 1, 00,000 which A and B would bring their capitals being in proportion to their profit sharing ratio.

Draw up the relevant accounts to close the books of A, B and C and prepare the opening Balance Sheet of A and B.

Illustration 9:

Kalyan agreed to take over the buildings at Rs 32,000 and Meena took over goodwill, stock and debtors at book values, leaseholds, at Rs 29,250 and machinery at Rs 5,780. Meena also agreed to clear the creditors. Somu took the investments at the agreed value of Rs 11,500. Pass necessary journal entire and show the Realisation Account, Partner's Capital Accounts and Bank Account. (B Com. Madurai)

Illustration 10:

The firm was dissolved on 31st December 2005 and the following was the result:

(1) A took over the investment at an agreed value of Rs 8,000. He also agreed to pay off the loan to Mrs. A.

(2) The assets realized as follows:

Stock Rs 5,000

Debtors Rs 18,500

Fixtures and Fittings Rs 4,500

Plant and Machinery Rs 25,000

(3) The expenses were Rs 1,100

(4) The sundry creditors were paid off less 2.5% discount.

A and B shared profits and losses in the ratio of 3: 2.

Journalise the entries to be made on dissolution and prepare the ledger accounts.

Insolvency of a Partner :

The Capital Account of a partner may show a debit balance because of excess drawals or losses on account of realisation or some other reasons. Such a debit balance is called Capital Deficiency.

If the Capital Account of a partner shows a debit balance as a result of various entries passed on account of dissolution of the firm, it is expected that he will pay the money from his estate. If this is done, the other partners will be able to get in full what is due to them.

If the partner is solvent, he will have to make good such capital deficiency by bringing cash. But if the partner is unable, he may not be able to pay off even his own private liabilities. In some cases, after paying the private liabilities, a small sum which is lesser than the amount due to the firm, may be given by the partner, whose capital account shows a debit balance.

When a partner is insolvent, then such a capital deficiency will be a loss to other solvent partners. For example, if there are two partners in a firm and if one of them is insolvent, then the capital deficiency will be borne by the other partner, who is solvent. But, when there are more than 2 partners, there arise problems as to the ratio in which the capital deficiency be borne by the remaining partners.

In such a case, the deficiency shown by the insolvent partner's capital account should be divided among the solvent partners in the ratio which has already been agreed upon by them for the purpose.

Prior to the decision in the leading case of Garner vs. Murray, this loss was borne by the solvent partners in the profit sharing ratio just like trading losses. No distinction was observed between trading loss and capital loss. The rule was laid down by Justice Joyce, in November 1903, in Garner vs. Murray.

Garner vs. Murray Decision :

Garner, Murray and Wilkins were partners, in a firm, sharing profits and losses equally. Their capitals were not equal. There was no partnership deed. The firm dissolved on 30th June 1900.

The position was as follows, after dissolution:

Mr. Wilkins became insolvent and could not pay anything against the capital deficiency. When the loss on realization is distributed, Garner Capital account would be reduced of £2,288 (£ 2,500 – 212), Murray's capital would be reduced to £ 102 (314-212) and Wilkins' capital deficiency would be increased to £ 474 (£ 263 + 211).

Such a loss which is due to capital deficiency, prior to Garner vs. Murray decision, was to be borne by the solvent partners in profit sharing ratio. But, here, Murray had raised an objection and claimed that the loss is a capital loss and not a business loss. Therefore, such loss due to capital deficiency of a partner to be borne in capital ratio and not in profit sharing ratio. Murray got the decision in his favour.

In Garner vs. Murray, a historic decision was given by Justice Joyce, upholding the contention of Murray i.e. capital deficiency of insolvent partner is a capital loss and is to be shared by the solvent partners, in capital ratio, just before dissolution.

Main Points of Garner vs. Murray Decision :

1. Loss due to insolvency is a capital loss.

2. Such loss, due to insolvency, is to be shared by solvent partners in their capital ratio just before dissolution.

3. All solvent partners should bring in their share or realization loss in cash.

4. If a partner's capital account shows a debit balance, he need not share the capital loss of the insolvent partner.

Application of Garner vs. Murray Rule in India :

The rule of Garner vs. Murray is applicable in India only if:

(a) There is no agreement to the contrary.'

(b) The capitals of partners are not in profit sharing ratio.

(c) There must be capital deficiency in a partner's capital account.

If there is a provision in the partnership deed as to the ratio in which losses or gains including losses arising from capital deficiency of a partner shall be borne, then the solvent partners will bear the insolvent partner's deficiency in that ratio.

In the absence of any such agreement, the adjustments shall be made according to the decision in Garner vs. Murray case. The amount left unsatisfied or unpaid by the insolvent partner has to be transferred to the capital accounts of the other partners in the ratio of their capitals just before the dissolution.

As regards the cash to be brought in by the solvent partners, it is only a notional entry, actually no cash is brought. Is India specially, there does not seem to be any need for the solvent partners bringing in cash equal to their share of the loss or realisation. But the main point decided in Garner vs. Murray that the loss is to be borne by the solvent partners in the ratio of their capitals just before the commencement of dissolution stands.

Fixed and Fluctuating Capitals :

If partners' Capitals are fixed, all adjustments regarding undistributed profits, interest on capitals, and drawings etc. are made in their respective Current Account.

The following steps may be followed after the completion of Realisation Account, when dealing with the capital deficiency of insolvent partner:

1. Transfer any undistributed profits or losses, reserve etc. to the Current Account of the partners in profit sharing ratio.

2. Transfer the loss of Realisation to the Partners' Current Account in their profit sharing ratio.

3. The insolvent partner's Current Account should then be transferred to his Capital Account in order to find out the total amount due from him.

4. The insolvent partner's total capital deficiency should be distributed among the solvent partners' Capital Account in the ratio of their Fixed Capitals and should be debited to their respective Current Accounts.

5. The solvent partners' Current Account should then be closed by transfer to their respective Capital Account. Then they are paid what is due to them from the firm.

Again, Fixed Capitals without any adjustments are taken as the last agreed Capital, to determine the ratio for the division of the capital deficiency among the solvent partners.

If partners' Capitals are fluctuating, then, their Capital Accounts undergo adjustments for drawings, undistributed profits or losses etc. to arrive at the ratio of the solvent partners' last agreed capitals.

In brief the following steps may be followed:

1. Transfer any undistributed profits or losses, reserves etc. to the Capital Accounts of the partners in profit sharing ratio.

2. Transfer the loss on realization to the Partners' Capital Account in profit sharing ratio.

3. If the decision laid down in the case of Garner vs. Murray is followed, the solvent partners should be asked to contribute further cash to make up their share of loss on realisation.

4. The insolvent partner's total capital deficiency should then be distributed among the solvent partners in the ratio of their capitals. The loss on realisation debited to the Capital accounts in neutralised by the corresponding credit for cash brought in by them. Then partners are paid what is due to them for the firm.

Illustration 1:

A, B and C were in Partnership sharing profits and losses in the ratio 8:5:3 respectively. The Capital Accounts were fixed under the partnership agreement, and as the result of continuous losses, the firm resolved to dissolve the partnership.

The Balance Sheet of the firm was as follow:

The firms' assets were realized as follows:

Plant – 1,200

Stock – 10,460

Debtors – 7,110

C was adjudicated as insolvent and could contribute nothing towards his deficiency in the firm. You required closing the books of the firm in accordance with decision in Garner vs. Murray.

Note: When separate Current Accounts are maintained. Fixed Capital System is followed. Therefore, the deficiency of the insolvent partner C is borne by A and B in the ratio of their Fixed Capital i.e. 10:4.

Illustration 2 :

A, B and C were partners sharing profits and losses in the ratio of 3: 2: 1.

On 31st December their Balance Sheet was as follows:

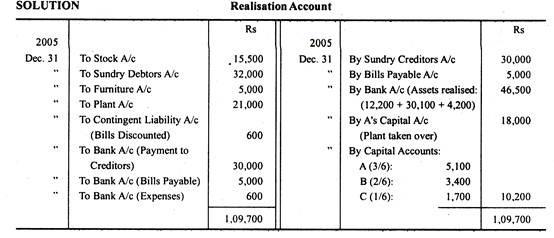

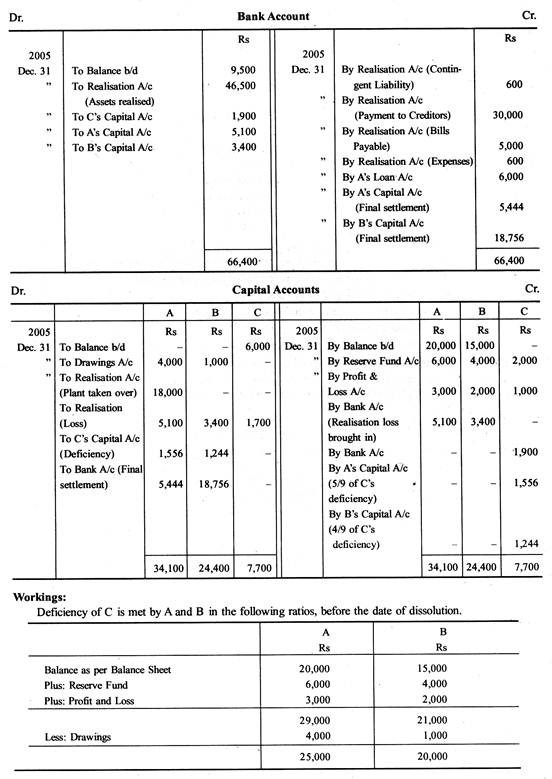

Plant is taken over by A at Rs 18,000. A contingent liability for Bill Receivable discounted materialized to the extent of Rs 600. Realisation expenses amounted to Rs 600. C is insolvent but his estate pays Rs 1,900. Prepare necessary accounts to close the books assumes that the capitals are fluctuating.

The ratio is 25,000: 20,000 or 5: 4

The deficiency of C comes to Rs 2,800 which is met by A and B in the ratio of 5: 4: Rs 1,556, Rs 1,244.

Illustration 3:

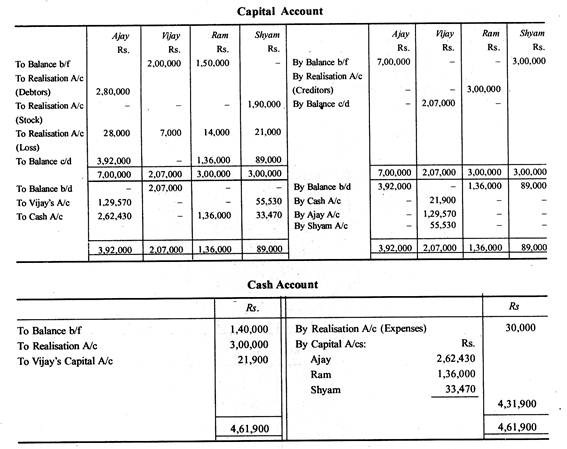

Ajay, Vijay, Ram and Shyam are partners in a firm sharing profits and losses in the ratio 4:1:2:3.

The following is their Balance Sheet as on 31st March, 2005:

On 31st March, 2005 the firm is dissolved and the following points are agreed upon:

Ajay is to take over sundry debtors at 80% of book value

Shyam is to take over the stocks at 95% of the value and

Ram is to discharge sundry creditors

Other assets realise Rs.3, 00,000 and the expenses of realisation come to Rs. 30,000

Vijay is found insolvent and Rs. 21,900 is realised from his estate.

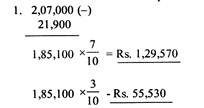

Prepare Realisation Account and Capital Accounts of the partners. Show also the Cash A/c. The loss arising out of capital deficiency may be distributed following the decision in Gamer vs. Murray.

Note: Vijay's deficiency will be borne by Ajay and Shyam in the ratio of 7: 3 i.e. opening Capitals of Rs. 7, 00,000 and Rs. 3, 00,000. Ram will not bear any portion of the loss since at the time of dissolution he had a debit balance in his capital account.

2. Sundry Creditors have been directly transferred to Ram's Capital Account instead of transferring it through Realisation Account.

Illustration 4: (Insolvency of more than one partner)

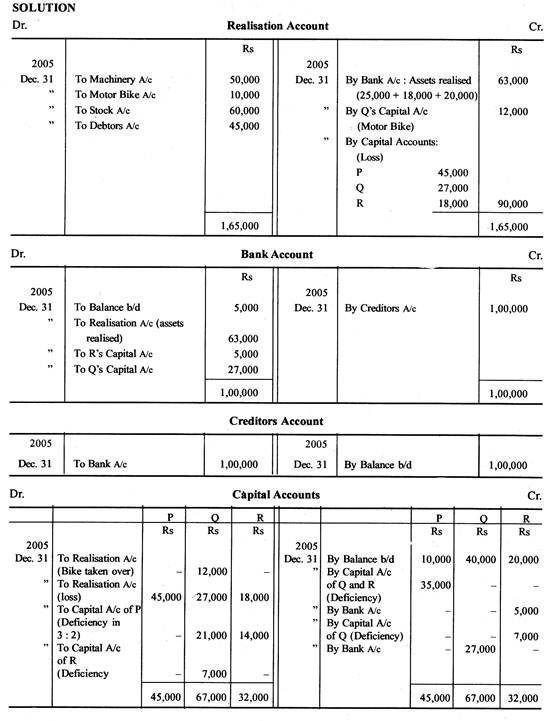

P, Q and R are partners sharing profits and losses as 5: 3: 2.

The business is dissolved on 31st December 2005 when the Balance Sheet stands as below:

Machinery and stock are sold for Rs 25,000 and Rs 18,000 respectively. Motor Bike is taken by Q for Rs 12,000. Debtors realise Rs 20,000.

According to Partnership deed, the deficiency of any partner in Capital Account is to be met by other partners in profit-loss sharing ratio.

P is insolvent and R can bring in Rs 5,000 only.

Prepare the accounts in the books of the firm.

Note: P is an insolvent and nothing can be contributed. Thus, P's deficiency of Rs 35,000 has been debited to Q and R in the ratio of 3: 2. Again, R could give only Rs 5,000 and this results in deficiency of Rs 7 000. This amount has again been debited to Q's Account.

When All Partners are Insolvent :

When the liabilities of a firm cannot be paid in full, then all the partners are said to be insolvent. If the partners of a firm are insolvent, obviously, creditors will have to bear the loss arising due to such event. That is, Creditors cannot be paid in full. The firm's liabilities would be more than the firm's assets and private assets of the partners, when all the partners of a firm become insolvent.

The steps are:

1. Realisation Account is prepared in the same manner described above. The external liabilities and their payments are not recorded in it. Only assets should be transferred to the Realisation Account. Realisation loss is transferred to Capital Account.

2. The cash available in the firm and received from private estate of the partners is paid to Creditors, after meeting the realisation expenses, if any. The unpaid balance will be transferred to Deficiency Account.

3. Balance of Capital Accounts of all partners should be transferred to Deficiency Account. Thus the books will be closed.

Illustration 1: (Insolvency of all the partners)

A and B were in equal partnership.

Their balance Sheet stood as under on 31st December 2005 when the firm was dissolved:

The expenses of realisation amounted to Rs 140. A's private estate is not sufficient even to pay his private debts, whereas in B's private estate there is a surplus of Rs 140 only.

Give necessary accounts to close the books of the firm.

Note: Since all the partners are insolvent, the creditors cannot receive in full. Partners' capital deficiencies will therefore be borne by them. Cash in hand together with amount realised on sale of assets and surplus from private estate of B has been applied in making the payment to the creditors after meeting the realisation expenses.

The balance of Creditors Account has been transferred to Deficiency Account. The balance of capital accounts has also been transferred to Deficiency Account to close the books.

Illustration 2: (All Partners are insolvent)

The Balance Sheet of A, B and C, who are sharing profits and losses in the ratio of 2: 2: 1, was as follows on 31st March, 2005, the date of dissolution:

Stock realised Rs. 52,000 and other assets were sold for Rs. 90,000. Expenses of realisation amounted to Rs. 3,000. Assuming that all the partners are insolvent, prepare the necessary ledger accounts to close the books of the firm.

Piece-Meal Distribution :

It has so far been presumed that the assets are disposed of on the same day of dissolution and liabilities are also simultaneously discharged. But in actual practice, the sale of assets realise gradually unless the business is sold to a buyer (vendee).

The dissolution process takes some time during which period assets are gradually realised. This is because assets are sold piece by piece and the realisation of assets will be slow and gradual.

Similarly the liabilities are paid gradually depending upon amount realized from the sale of assets. Therefore, the final results are known only when all assets are completely realized and all liabilities are completely discharged.

On realisation of assets, the cash realised is distributed in the following order:

1. Payment of realisation expenses.

2. Payment to outside liabilities i.e. Creditors, Overdraft, Bills Payable, Outstanding expenses etc.

3. Payment of Partner's loans and advances.

4. Payment of Partners' balance in Capital Accounts.

After making payments to outside liabilities and partner's loan, the capitals of the partners are returned. Unless the profit or loss on realisation is known, the amount payable to partners cannot be ascertained.

If it is so, it means that the partners should not be paid till the realisation is complete. This creates a problem. This is because the profit or loss on account of realisation is to be credited or debited to Partners' Capital Account.

It is also necessary to see that all partners have been paid and the unpaid balance of each partner being a loss must be in the ratio of profit and loss sharing ratio. It is, therefore, necessary to find out a method by which the partners are paid, as and when cash is received, without waiting till the realisation of all assets and at the same time to ensure that no partner is paid in excess and amounts left unpaid are in profit and loss sharing ratios.

Basis of Distribution :

When a firm decides to make distribution of cash as and when received, there arises a problem of determination of basis i.e. ratio in which the available cash is to be distributed, keeping share of loss to each partner in profit and loss sharing ratio. The capital contribution or balance in the Capital Account of the Partners may not be in their profit and loss sharing ratio.

The ultimate realisation loss cannot be ascertained when the distribution of cash is made on the interim basis. In such case, when the Capital is not in profit and loss sharing ratio, whichever ratio is followed, the loss shared by the partners will not be in profit and loss sharing ratio. See Illustration 17.

Illustration:

A and B, are partners with Capital of Rs. 5,000 and Rs. 15,000 and share the profit and loss in the ratio of 2/3 and 1/3 respectively.

The firm wound up and after paying off Creditors, the firm collected Rs 3,000 as first installment and Rs 4,500 as second installment and distributed the amount on the basis of profit and loss sharing ratio, then the distribution as follows:

Here the loss is not in profit and loss sharing ratio. But the loss goes to B alone. The loss that they should bear should also be in 2: 1 ratio. Therefore, this method is not suitable.

Suppose the distribution is made on the basis of the Capitals, then the distribution is as follows:

Here, the loss is not in profit and loss sharing ratio. But the loss suffered by A and B in the ratio of 23: 77 (2,875: 9,625) whereas the profit and loss sharing is 2: 1. Therefore, this method is also not suitable.

Out of the available cash (as mentioned above), distribution of cash may be done in the following manner:

1. First, outside liabilities are to be paid

2. Secondly, Partners Loans or Advances are to be paid

3. Thirdly and lastly, Partners' Capital are to be paid

Now the question arises how the available cash to be distributed to the partners. The balance in the Capital Accounts of Partners may not be in profit sharing ratio. It is necessary to see that after making payments to partners, the unpaid balance of each partner, being a loss must be in Profit Sharing Ratio.

Therefore, if the Capitals of the Partners are not in profit sharing ratio, then in order to make the Partners' Loss on realisation in their profit and loss sharing ratio and to make equitable distribution of cash, on piece-meal basis, without affecting the interest of Partners, either of the following two methods can be adopted:

1. Surplus capital Method (Proportionate Capital Method)

(or) 2. Maximum Possible Loss

I. Surplus Capital Method (Proportionate Capital Method) :

When the Capitals of the Partners are not in proportion to their profit and loss ratio, the partner who has contributed more than his proportionate share of capital is paid first, in priority to the other partners.

For this purpose, the Surplus Capitals are to be found out on the basis of profit and loss sharing ratio. Thus, the initial payments are made in such a way that the capitals of all the partners are adjusted to their profit and loss sharing ratio. When this is done, the capitals will be in proportion to the profit and loss sharing ratio.

The steps are detailed below:

1. Divide undistributed profit, if any, among the Partners, in profit and loss sharing ratio.

2. Pay off realisation expenses or make a provision for it.

3. Pay off outside liabilities. If the amount is insufficient, then apportion the amount in the ratio of their claims.

4. After paying off the outside liabilities, pay off Partners' Loans when more than two partners are there and available cash is insufficient, then apportion the amount in the ratio of their claims.

5. Now partners' capitals are to be refunded. Find out the amount payable to Partners whose capitals are relatively in excess of their profit and loss sharing ratios. When the excess amounts have been paid off, the ratio of remaining balances in the Capital Account and profit and loss sharing ratio are one and the same.

To find out the excess capital, the following steps are needed:

(a) Partners' actual capitals are divided with their respective ratio figures.

(b) Take the relatively lowest capital as the base and find out notionally adjusted capital.

(c) Find out the excess of capital by comparing actual capital and notional capitals.

(d) Repeat these above steps till the number thereof reduced to one partner.

(e) Then, start paying off from the last ultimate excess first, then preceding excess till all the excesses are paid off.

(f) The balance i.e. the unpaid capitals (or losses) will be in profit and loss sharing ratio. Generally the unpaid balance would be loss on realisation.

II. Maximum Possible Loss:

Under this method, it is assumed that at every stage of realisation of assets; think that the remaining unrealised assets are worthless. Therefore, at every stage loss can be ascertained and this loss is distributed among the partners in profit and loss sharing ratio. The balance in the capital accounts and the cash available will be equal and the cash is paid.

The steps are:

1. Pay off Creditors first and then partners' loan account if any, out of the realised amounts.

2. Now the capitals are there to be paid. Whenever any cash is received, find out the difference between the available cash and the balance in the capital accounts. This difference is maximum loss.

3. The Maximum Loss is distributed to Capital Accounts in profit and loss sharing ratio, that is from the Capital Account, the share of losses are deducted.

4. Now distribute the available cash among the partners according to their Capital Accounts as adjusted above. Here the cash available equals the sum of the partners' adjusted credit balance.

5. If any partners' capital shows a debit balance, write it off according to Garner vs. Murray ruling.

As and when further realisations are made and cash is to be distributed, the above procedure is to be followed, in all subsequent payments among the partners.

Illustration 1:

A, B and C are partners sharing profits and losses as 5: 3: 2.

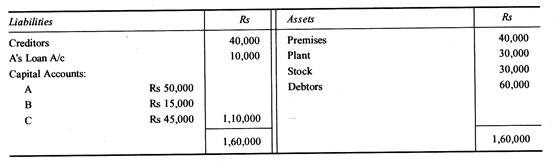

The following is their Balance Sheet as at December 31st 2004, when they dissolve the business:

It was agreed to repay the amount due to the partners as and when the assets were realized, viz.

1st February 2005 – Rs 30,000

1st April 2005 – 73,000

1st June 2005 – 47,000

Prepare the statement showing how the distribution should be made and write up the Cash Account and Partners' Capital Accounts.

(B.Com. Madurai; Punjab; Agra; MK)

Solution :

We solve the problem in both the methods i.e. Surplus Capital Method and Maximum Possible Loss Method:

(a) Surplus Capital Method :

When the capitals of the partners are not in proportion to their profit and loss ratio, the partner who has contributed more than his proportionate share of capital is paid first, in priority to the other partners.

After paying off the outside liabilities and Partner's Loan, the capitals are refunded to partners whose capitals are relatively in excess of their Profit and Loss sharing ratio. In this problem, the capitals are not in their profit sharing ratio.

Therefore, the capitals of the partners which are in excess of the profit sharing ratios would be reduced by payment from time to time until the capitals of all the partners are brought on a level with their profit sharing ratio. To find out the surplus capital, we have to prepare a statement showing the cash distribution.

Note: Priority of Cash distribution:

1. First pay off Creditors Rs 40,000 and A's Loan Rs 10,000

2. Next make refund of Capitals:

(a) Pay Rs 25,000 to C (Ultimate Surplus)

(b) Pay Rs 25,000 to A and Rs 10,000 to C (Surplus)

(c) Then, cash is distributed to A, B and C in profit sharing ratio.

Solution:

(b) Maximum Possible Loss :

It is assumed that at every stage of realisation of assets, the remaining unrealised assets are worthless. Therefore, at every stage, the loss can be ascertained and this loss is distributed among the partners in Profit and Loss sharing ratio. Then the balance in the capital accounts and the cash available will be equal and cash is paid.

Illustration 2: (Illustration No. 1)

Illustration 3: (Surplus Capital Method)

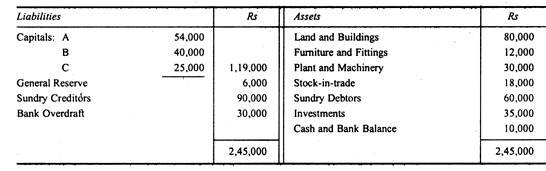

A, B and C trade in partnership sharing profits and losses in the ratio of 3: 2: 1.

They decide to dissolve the firm with effect from 1st January 2005 when the firm's Balance Sheet stood as follows:

The assets are being realised gradually. After meeting the expenses of realisation, the first installment of realisation including cash and bank balance fetches Rs. 75,000; the second Rs. 32,000, the third Rs. 60,000 and the fourth Rs. 63,000.

If distribution amongst partners is to be made after each installment of realisation, as far as possible, prepares a statement showing the distribution to partners at each installment although the final results were not yet known.

Priority of distribution:

1. First day off to the Creditors and Bank Overdraft, totaling Rs. 1, 20,000.

2. Then surplus of Rs 5,000 to C.

3. Then surplus of Rs 4,000 to B and Rs 2,000 to C.

4. Then available amount is distributed in profit sharing ratios.

5. Ultimately, the final unpaid balance is losses to partners and as in profit and loss sharing ratios.

Illustration 4:

A, B and C were in partnership sharing profits and losses in the proportion of 1/2, 1/3 and 1/6 respectively.

The Partnership firm was dissolved on 30th September 2005 when the position was as given below:

The Partners desired that the net realisation should be distributed according to rules at the end of each month.

The realisations and expense were as under:

Illustration 5 :

A, B and C are in partnership sharing Profits and losses in the ratio of 3: 2: 1.

They decided to dissolve the business on 31.12.2006 on which date their Balance Sheet was as follows:

The assets were realized piece-meal as follows and it was agreed that cash should be distributed as and when realized.

15.1.2007 —Rs. 10,380;

20.2.2007 — Rs. 27,900;

23.3.2007 — Rs. 3,600;

15.4.2007 — C took over the investments at Rs. 1,260;

27.4.2007 — Rs. 19,200

Dissolution expenses were originally provided for an estimated amount of Rs. 2,700 but actual amount spent on 29.3.2007 was Rs. 1,920. The creditors were settled for Rs. 10,080. You are required to prepare a statement showing distribution of cash amongst the partners.

Statement Showing Priority of Distribution :

First, Rs. 10,080 to be paid to the creditors (adjusting discount) after providing Rs. 2,700 for dissolution expenses.

Next, Rs. 3,000 to be paid to C for loan.

Next, Rs. 5,400 to be paid to A for Absolute Surplus.

Next, Rs. 23,040 to be paid to A and C in the ratio of 3: 1. (Rs. 17,280: Rs. 5,760)

Balance to be paid to A, B and C in the ratio of 3: 2 : 1.

Working Note:

(1) Technically, C will be allowed to take over investments only after the realisation of 27th April.

(2) Out of realisation of 27.4.2007 Rs 3,780 (1,260 x 3) to be paid to A and Rs 2,520 (1,260 x 2) to B to adjust the value of investments taken over by C. The balance is to be distributed among A, B and C in the ratio of 3: 2: 1.

Illustration 6 :

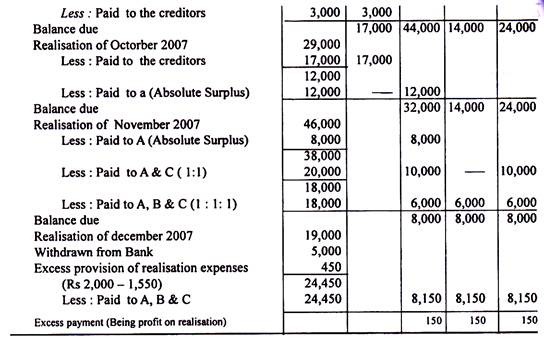

A, B and C carrying on business in the partnership decided to dissolve it on and from 30th September 2007.

The following was their Balance sheet on that date:

As per the arrangement with the bank, the partners were entitled to withdraw an amount of Rs. 5,000 only at present and the balance amount of Rs. 5,000 could be withdrawn after 1st December, 2007. It was actually withdrawn on 20th December, 2007.

It was decided that after keeping aside an amount of Rs. 2,000 for estimated realization expenses the available cash should be distributed between the partners immediately.

Actual realization expenses amounted to Rs. 1,550 only. Prepare a statement showing the distribution of cash between the partners applying the "Surplus capital method".

The following were the realisations:

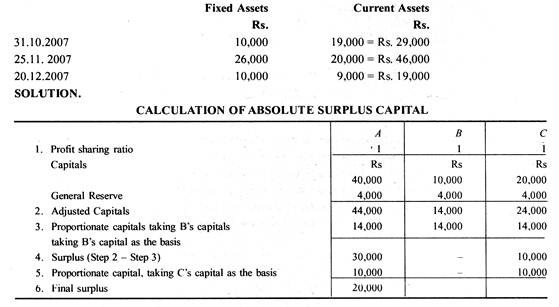

Statement showing priority of Distribution :

First, Rs. 2,000 should be kept for realisation expenses

Next, Rs. 20,000 to be paid to the creditors

Next, Rs. 20,000 to be paid to A (absolute Surplus Capital)

Next, (Rs. 10,000 + Rs. 10,000) = Rs. 20,000 to be paid to A & C equally

Balance to be paid to A, B & C equally

Source: https://www.yourarticlelibrary.com/accounting/partnership-account/dissolution-of-partnership-firm-accounting-procedure/52439